Tax Day is next Tuesday, April 18 — unless you’re a Californian living in a flood-affected county.

If you’re a resident of San Francisco or the eight other Bay Area counties, that’s you. Taxpayers in all nine Bay Area counties have until Oct. 16, 2023, to file and pay both state and federal taxes, without filling out any additional paperwork to use this extension.

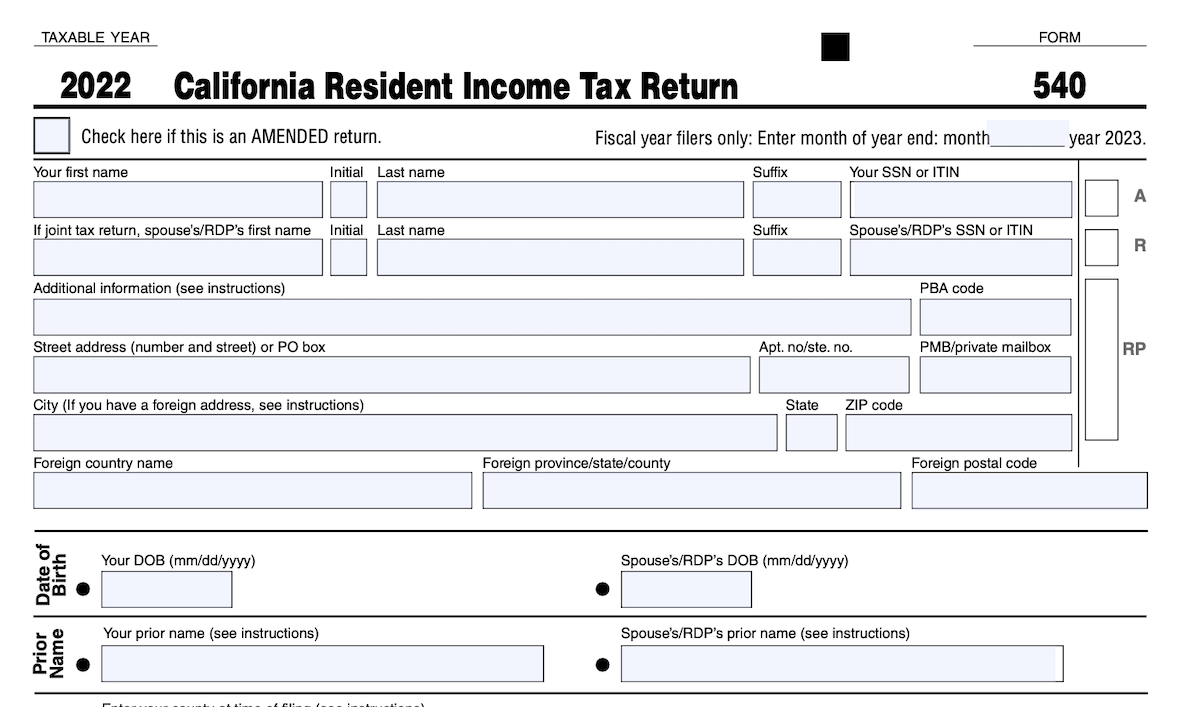

The extension applies to individual tax returns, business returns, and returns for tax-exempt organizations. It also applies to taxpayers who hope to contribute to their health savings and IRAs for 2022; they now have until October to do so.

Fifty-one of California’s 58 counties are included in the extension, all except Imperial, Kern, Lassen, Modoc, Plumas, Shasta, and Sierra counties, the IRS announced in February.

“The only case in which this doesn’t apply,” said Steven Axelrod, an accountant on Valencia Street, “is for people who have out-of-state returns.”

Anyone who receives an income in another state must pay and file those income taxes by the April 18 deadline, Axelrod said.

For more information, read the federal and state extension announcements. And if you’re one of the three-quarters of Americans who make less than $73,000 annually, you can file your taxes for free using the IRS Free File system.